Case Study: Empowering Medical Interlibrary Loans

The Medical Library Association’s medical library members sought an interlibrary loan (ILL) billing system to allow them to easily bill one another for loans, without significant overhead managing complex invoicing systems. A previous solution had been built more than two decades ago by one of the system’s members, but it was outdated, insecure, and relied on manual processing.

This unique project involved “crowdfunding” the solution, which kept the initial cost very reasonable for each member. Each library that sought to participate paid a modest setup fee, which in aggregate paid for the implementation of the year-long project.

Problem

The new EFTS system would need to solve several key problems present in the old system:

- Reduce EFTS staff overhead by using technology to automate day-to-day administration tasks (while ensuring backwards compatibility with the previous system’s proprietary file upload format).

- Eliminate data entry errors and double-billing problems by providing a real-time data integration.

- Solve collections and fund overdraw problems.

- Leverage modern self-service secure payment technologies to allow members to more easily fund their accounts.

- Ensure financial integrity of the overall system.

Solution

With the old system going offline, Tecture developed its replacement in a phased approach to quickly launch basic functionality and minimize downtime.

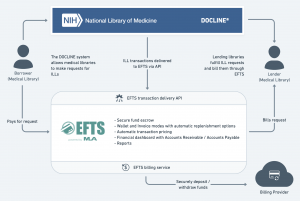

Tecture and MLA worked in conjunction with the National Library of Medicine (NLM), which operates a system for ILLs called DOCLINE. The DOCLINE system is the tool that libraries use to request inter-library loans. Tecture designed and implemented a custom data exchange API and worked with DOCLINE’s developers to integrate it into their system so that ILLs from EFTS members would be sent from DOCLINE to EFTS automatically, eliminating the need to manually enter them (and ensure data accuracy). While the new system still supports file uploads, this API-based automation gives members flexibility, transparency, and accuracy.

Our new design draws on accounting systems for inspiration. We introduce an innovative Lending (Accounts Payable) / Borrowing (Accounts Receivable) dashboard to allow members to track their accounts in real-time. Our billing service prevents any member from overdrawing their account balance, and instead shows unpaid transactions under “Accounts Payable.”

To eliminate collections problems, and empower members, Tecture create a “Wallet” concept in which members can deposit funds. Those funds are used to pay for transactions in real-time (similar to electronic tollway wallet systems). Members can add funds securely via ACH or credit card, and includes an option for automatic funding when an account balance drops below a configurable threshold.

Keys to Project Success

This project required a high level of care and detail to ensure success of the project and rollout:

- Tecture performed a careful evaluation of the old system to ensure the new solution would be backwards compatible and that existing software integrations in place at many libraries would continue to operate smoothly.

- Tecture performed an extensive user experience study to design a new system in coordination with its members, the MLA, and the NLM.

- EFTS funds were held in escrow and needed to be carefully transferred into the new system. Tecture devised a series of checks to ensure funds moved quickly and accurately.

- Tecture rolled out the new system in a carefully phased approach, giving us an opportunity to identify any gaps in our understanding of the requirements (it is impossible to interview each of the thousands of members who use the system) and swiftly adjust.

- Tecture migrated key data elements from the previous system to ensure a seamless transition to the new system that would not result in overlapping transactions or double billing.

- Tecture performed a financial reconciliation to ensure that all fund transfers in and out of the system balanced.

Key System Features

Wallet and Invoicing Options

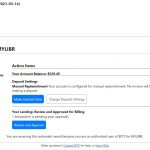

At the core of EFTS is a choice of account type. With Wallet, members deposit funds into their accounts, and as transactions flow into their account from lenders, they are paid instantly (similar to a highway toll payment system). With Invoice, members receive a standard monthly invoice for their borrowing activities throughout the month.

Accounting System Paradigm

EFTS was designed with inspiration from a review of various accounting and payment systems, such as PayPal and Quickbooks, taking the core concepts of Accounts Receivable, Accounts Payable, and Unsettled, to allow its members to understand factors affecting their accounts at all times. Lending activities are equivalent to Accounts Receivable, while Borrowing is Accounts Payable. The system also exposes unbilled transactions, which allows members to determine how much they should fund their accounts to ensure swift processing.

Data Integrations

Tecture built EFTS to integrate seamlessly into MLA’s existing technology platforms, including its Association Management System (AMS) for security and Single Sign On (SSO) capabilities, its billing platform, and its accounting platform, leveraging both API integrations and synchronization features. This ensures that MLA can accurately keep track of all funds transmitted in and out of the system, while providing members with easy ways to securely pay bills electronically and, if desired, automatically.

Real-Time Data Transparency

The real-time API integration with DOCLINE allows both lenders and borrowers to easily track upcoming charges/income via their EFTS dashboard.

Pricing Automation

An option to further reduce manual date entry is pricing automation, in which libraries may configure a set of pricing rules. These rules are based on billing groups, and automatically set transaction prices based on loan type and service level parameters.

User Experience

While we are extremely proud of the technology that powers this billing system, the extremely simple and well-thought-out user experience is what makes it a successful tool for its members. A simple dashboard allows libraries to see their account status at a glance. And, a weekly email to each member is a straightforward summary of key actions each much take (from processing refunds to funding their account) to keep the system running smoothly.